News and Announcements

Altech – Listed Green Bonds In Final Stage

- Published August 24, 2021 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

Highlights

- Listed green bond targeting an offer of ~US$144m for Malaysian HPA plant

- Final preparations near completion

- Marketing of bonds to commence during this quarter

- Malaysian HPA project 49% less carbon footprint than conventional HPA

Altech Chemicals Limited (Altech/the Company) (ASX: ATC) (FRA: A3Y) is pleased to advise that preparations for its proposed listed green bond offering of ~US$144 million, to provide additional financing for its Malaysian high purity alumina (HPA) project, are in the final stages.

Altech has been working with London based structuring agent, Bedford Row Capital PLC (Bedford Row) and Bluemount Capital (WA) Pty Ltd (Bluemount) to prepare for the green bond offering. Extensive due diligence has been completed, including financial, legal and environmental social governance. Legal counsels from various jurisdictions have now completed their respective reviews of documentation, and the bond issue process will shortly move from the preparation phase to marketing and finally initiation.

The initiation phase of the offering will include the distribution of comprehensive corporate presentation packs and will be followed by detailed briefings to potential subscribers. As is customary with these types of offerings, it is anticipated that subscriptions for the bonds will be received in several tranches over a period of months, rather than as a single tranche and closing for the entire US$144 million offering amount. Bedford Row has reported that its initial preliminary marketing (“soft sounding”) during the preparation phase had been positive.

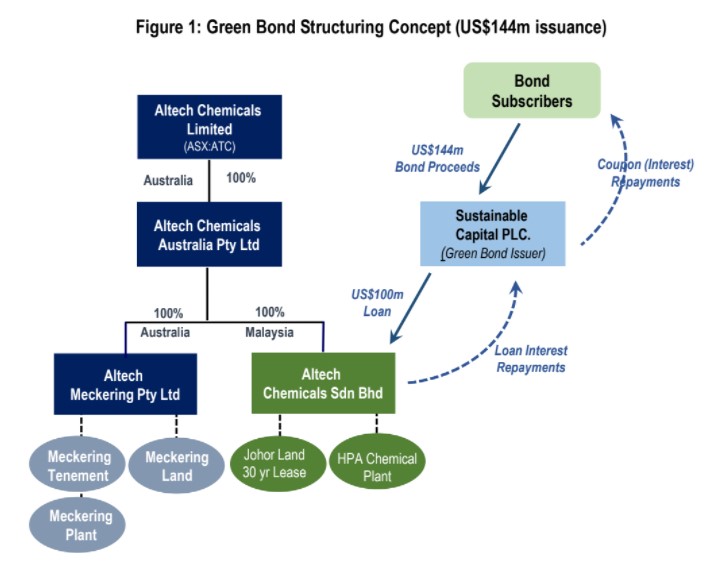

Altech is aiming to raise US$144m from this bond issue (Series 2021-F3 Notes), of which US$100m will be used as secondary debt for construction of its Johor HPA plant, with the balance of US$44m to service bond coupon (interest) during the HPA plant’s construction phase – see Figure 1. The bonds will be issued by Sustainable Capital PLC, incorporated in United Kingdom, a dedicated green bond issuance platform (www.sustainablecapitalplc.com). The bonds will be second lien to the senior project finance of US$190m that has already been committed by German government owned KfW IPEX-Bank.

Background

Increasingly green bonds are being used to finance new and existing projects which deliver environmental benefits and a more sustainable economy. As announced on 20 May 2020, Altech’s HPA project has been formally assessed as “green” by the independent Centre of International Climate and Environmental Research (CICERO) based in Oslo, Norway. Compared to conventional HPA processing, Altech’s disruptive HPA production technology is estimated to deliver a ~49% reduction in the comparable carbon footprint, and use ~41% less energy. Also, the primary end-use for Altech’s HPA is targeted for climate change products, such as LEDs lights and lithium-ion batteries.

As illustrated in Figure 1 below, Sustainable Capital PLC is the bond Issuer. From a US$144m issue, US$44m would be retained by the SPV to service bond coupon (interest) payments during the period of Altech’s HPA plant’s construction and commissioning. The US$100m balance of proceeds is lent by the SPV Co. to Altech’s Malaysian subsidiary (Altech Chemicals Sdn. Bhd.) to part-fund plant construction costs and/or for working capital. It is envisaged that the bond will be for an initial 5-year term, and typical of this type of funding would likely be re-financed at a lower coupon (interest rate) towards the end of the term. Sustainable Capital PLC would take second lien security behind senior lender KfW IPEX-Bank.

About Altech Chemicals Ltd

Altech Chemicals Ltd has developed the technology to nano-coat particles of graphite and silicon, typical of those used in lithium-ion batteries, with a layer of high purity alumina. The use of alumina coated graphite and silicon particles within a lithium-ion battery anode are offered as a solution to increased battery life, energy capacity and a reduction of the first-cycle-loss capacity. The Company recently announced the commencement of a pre-feasibility study for the construction of a battery materials HPA coating plant in the Schwarze Pumpe Industrial Park, Saxony, Germany. Alumina feedstock for the plant would be supplied from Altech’s Malaysian high purity alumina (HPA) plant. The Company is currently working to close the balance of project finance for its vertically integrated (HPA) project that comprises a 4,500tpa high purity alumina (HPA) processing plant at Johor, Malaysia and a 100%-owned kaolin mine at Meckering, Western Australia.

Company Updates

Backed By Leading Investment Groups and Family Offices