News and Announcements

Connexion Media Shareholder Update

- Published May 26, 2015 3:18PM UTC

- Publisher Wholesale Investor

- Categories Company Updates

26 May 2015, Melbourne, Australia

Flex vehicle management service roll out

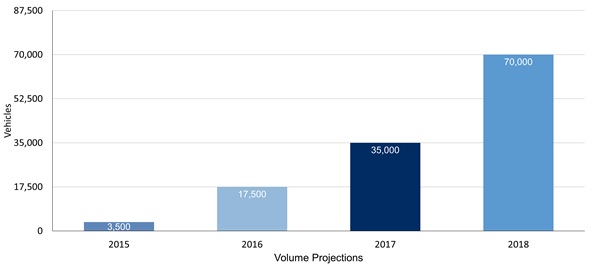

- Flex estimated to reach 70,000 paying monthly subscribers by 2018

- One US automaker will offer Flex throughout North America via its 4,000+ dealer network

- Strong pipeline of prospective new automakers and other suppliers expected to expand sales

Connexion Media Limited (ASX:CXZ) is pleased to provide further updates on the company’s distribution and sales strategy for the Flex vehicle management service.

Connexion has prepared Flex volume estimates for CY2015-18. The estimates do not include prospective new business opportunities with other partners and affiliates.

Flex is Connexion’s leading innovative cloud based integrated vehicle management service. Flex is designed to work with both new and aftermarket vehicles through both embedded and dongle solutions. The revenue model is based on a monthly subscription service fee per vehicle.

As previously announced, Connexion has been awarded a contract with a major US-based automaker to supply Flex as an embedded service in new production vehicles used in small business fleet vehicles.

The projected ramp up of the customised Flex service is expected to begin later this year. The US automaker will offer the service throughout North America via its over 4,000 dealer network.

At the request of the US-based automaker, Connexion is unable to disclose the party until the official Flex service launch in late 2015.

Figure 1: Flex Estimated Cumulative Volume Projections

The volume projections depicted in the above table are based on:

- volume estimates resulting from projected and anticipated take up of the Flex service with partners and affiliate

- the number of fleet vehicles sold in the US in 2014 were in excess of 1 million

- the US-based automaker that Connexion is customising its existing Flex service for has a market share in the range of 10-20%

Accordingly, the volume projections in the above table assume:

- the number of fleet vehicles sold annually equals or exceeds the number of fleet vehicles sold in the US in 2014

- the US-based automaker’s current market share does not significantly decrease

- the projected subscription take up rate set out above is consistently achieved

The US automaker will pay Connexion to customise the existing Flex service to meet its market requirements. The subscription-based service is expected to launch in the last quarter of 2015 with revenue generated from the service to be shared by both parties.

The cumulative volume projections based on existing contracts are estimated at 17,500 subscribers in 2016, rising to 70,000 subscribers in 2018.

Connexion has a pipeline of other prospective large scale buyers in trial or negotiation phases. Currently Flex is undergoing trials across the globe in Australia, USA, Germany, Thailand, China and the UK by a number of well-known high profile auto manufacturers and other prospects.

In the US, two major automakers have expressed interest in and are trialling Flex, while in Europe five major automakers are also trialling Flex. These automakers collectively represent 30+% and 20+% of annual sales in their respective markets(1).

Connexion is also receiving strong interest from automotive and consumer aftermarket brands, as well as automaker suppliers.

In addition, Connexion has already signed up a small number of paying customers in Australia, with revenues from these customers expected to be received in the June quarter of 2015.

Flex is achieving cut through success because the offering closely matches the specified needs of automakers, it can be quickly adapted to particular needs, it is co-optimised and can be branded by the automaker, the cost of Australian software engineers is competitive in the Western world and this can all be achieved with a competitive unit price for the consumer.

Further, Connexion has been cultivating the world’s major automakers for many years with the very competitive miRoamer radio and music service. It is using these existing channels with the vehicle giants to promote and sell the Flex product.

The overall fleet markets are vast. In America alone, the total number of industry cars and trucks managed by fleets is 11,876,033 as of January 2014, which is 130,000 vehicles higher than it was in January 2013(2).

It is estimated that the number of active fleet management systems is growing at between 14-22% annually(3). In Europe, China and the Americas expectations are that there will be in excess of 25 million fleet management systems installed by 2019(4). Worldwide, the total market value of fleet management systems is expected to grow over the next five years at an average of 24% per annum from US$12 billion in 2014 to almost US$35.5 billion by 2019(5).

Connexion has estimated that it will reach 70,000 monthly paying subscribers by 2018. This represents less than 1% of the world market for fleet management systems global estimates. Connexion expects to grow its market share considering the numerous automakers and aftermarket suppliers currently trialing the Flex service in USA, Europe, and Asia.

Flex is a new high tech remote vehicle management system, available as either a dongle and/or embedded solution. The service provides the ability to manage an entire fleet of vehicles from a central control point using cellular mobile connectivity. Flex collects data on key performance indicators that is then assessed using customised reporting.

Flex is able to track a range of real time and historical data including vehicle locations, distance travelled, fuel consumption, battery life, engine performance and absolute and average speeds travelled. It is also able to monitor driver behaviour and instantly notify vehicle owners and fleet managers by sending notifications and alarms.

For fleet managers, this technology is vital as it provides analytical data in how the vehicle is being used, that was previously unattainable.

For more information on Flex visit: www.flexvs.com

References:

(1) Source: IHS 2015 production estimates

(2) Source: USA Department of Transportation (DoT), Bureau of Transportation and Statistics, February 2015

(3) Source: Fleet Management System Market in Europe 2014-2018 (October, 2014: Infiniti Research Limited). Fleet Management in Europe, Fleet Management in the Americas, Fleet Management in China (Berginsight.com – M2M Research Series 2014), Fleet Management Market to See Healthy Growth in North & Latin America (30 September 2014, www.gpsbusinessnews.com/Fleet-

(4) Source: ibid

(5) Source: Fleet Management Market – Global Forecast to 2019 (November, 2014) www.researchandmarkets.com (at businesswire.com November 7, 2014)Source: IBIS World, OD4546 Fleet Telematics Systems Industry Report, March 2015

IMPORTANT NOTE:

It should be noted that if any of the assumptions underlying the information in Table 1 are incorrect or do not materalise, the volume estimates depicted in Table 1 may not be achieved. It should also be noted that, at this stage, Connexion has been contracted to customise its existing Flex service at the US-based automaker’s cost only. Theservice offering is therefore yet to launch and accordingly, Connexion does not have any contracts in place as part of these arrangements that guarantee any ongoing or significant sales or revenue in respect of the Flex based service offering. The above projections are not guarantees of future sales or revenue and involve a number of uncertainties and assumptions that are beyond the control of Connexion. Connexion gives no assurances that the volume estimates above will actually occur and the market is cautioned not to place undue reliance on these volume estimates.

About Connexion Media

Connexion Media Ltd (ASX:CXZ) is a technology company specialising in developing and commercialising software apps and services for the web connected car, mobile device and connected consumer electronics markets. It is based in Melbourne Australia, with a sales office in Cambridge UK.

Company Updates

Backed By Leading Investment Groups and Family Offices