News and Announcements

Genex Starts Construction at Flagship Pumped Hydro Storage Project

- Published February 03, 2022 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

Genex has begun tunnel digging at its flagship pumped hydro energy storage project in Queensland.

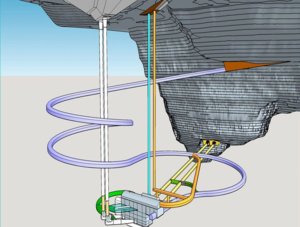

Genex is developing the Kidston pumped hydro project, which will provide 250MW/2,000MWh of storage capacity by repurposing two abandoned gold mine pits.

Genex can use the site as an energy storage facility by transferring water between the two pits that are at different heights.

Throughout December and January, Genex worked hard to build an underground main access tunnel at the Kidston site, which will provide access to a ‘powerhouse’ cavern being built 250 metres below ground level.

The main access tunnel will be six metres wide and six metres tall, and will run for approximately 1.5 kilometers to provide access.

The powerhouse will house two 125MW Andritz hydro reversible pump turbines, which will be used to generate electricity as well as pump water for energy storage.

Gravity is used to store energy in pumped hydro energy storage projects by transferring water between reservoirs of varying heights. Electricity is used to store energy by pumping water to a higher reservoir, which can then be released and used to generate electricity as needed.

The start of major engineering work at the site, according to Genex CEO James Harding, is a significant milestone for the project.

“Following an intense period of site establishment and preparation work, I am delighted that the EPC Contractor JV of McConnell Dowell and John Holland has formally commenced the underground excavation works for the Kidston Pumped Storage Hydro Project,” said Harding.

“This marks a significant milestone in the project’s construction timeline, which was met ahead of schedule.” We look forward to collaborating with the EPC JV and keeping the market informed as the program moves forward this year.”

Genex expects to finish the main access tunnel in early 2022, with tunneling operations continuing 24 hours a day, seven days a week after the first major blast and excavation work required to establish the tunnel.

When completed in Q4 2024, the Kidston venture will be Australia’s fourth operational pumped hydro venture and one of the first to be built in several decades.

The only operational pumped hydro energy storage projects in Australia are the Tumut 3 power station, which is part of the Snowy Hydro scheme, the Shoalhaven Scheme (both in NSW), and the Wivenhoe power station (in Queensland).

A fifth project is also being developed as part of the Snowy 2.0 project, which when completed will be Australia’s largest energy storage project.

The project is being developed by Genex, which has received a $610 million investment from the Northern Australia Infrastructure Facility and a $47 million grant from the Australian Renewable Energy Agency.

Last year, the ASX-listed Genex raised an additional $115 million through the issuance of new shares to raise the remaining funds for the $777 million pumped hydro energy storage project.

Genex’s project financials, released last year, show that the company expects to generate consistent revenue from the project after signing an energy storage service agreement with EnergyAustralia.

Through the contract, Genex will receive regular access payments from EnergyAustralia, which will then be able to draw on the Kidston storage project for additional electricity supplies during critical periods, assisting the electricity retailer in mitigating its exposure to electricity price spikes during peak demand periods.

Along with the Kidston storage project, Genex is developing a portfolio of clean energy projects, including a 50MW solar project on the Kidston site, a 50MW solar project in NSW, and the 50MW/100MWh Bouldercombe big battery project in Rockhampton.

Company Updates

Backed By Leading Investment Groups and Family Offices