News and Announcements

Kinesis Monetary System gathers momentum, taking Seoul by storm ahead of public sale launch

- Published September 10, 2018 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

KEY TAKEAWAYS:

- September the 10th 2018 marks the first day of Kinesis’ public token sale

- They sold over $55million worth of Kinesis Velocity Tokens (KVTs) during their pre-sale

- Last week the team returned from their trip to Korea, where they met with investors and gained great press coverage from Tokenpost, Asia Today and etnews

- Head of sales and Trading, Ryan Case, was interviewed by ICO Radio

- Thomas Coughlin, CEO, was interviewed by renowned business newspaper in London, City AM

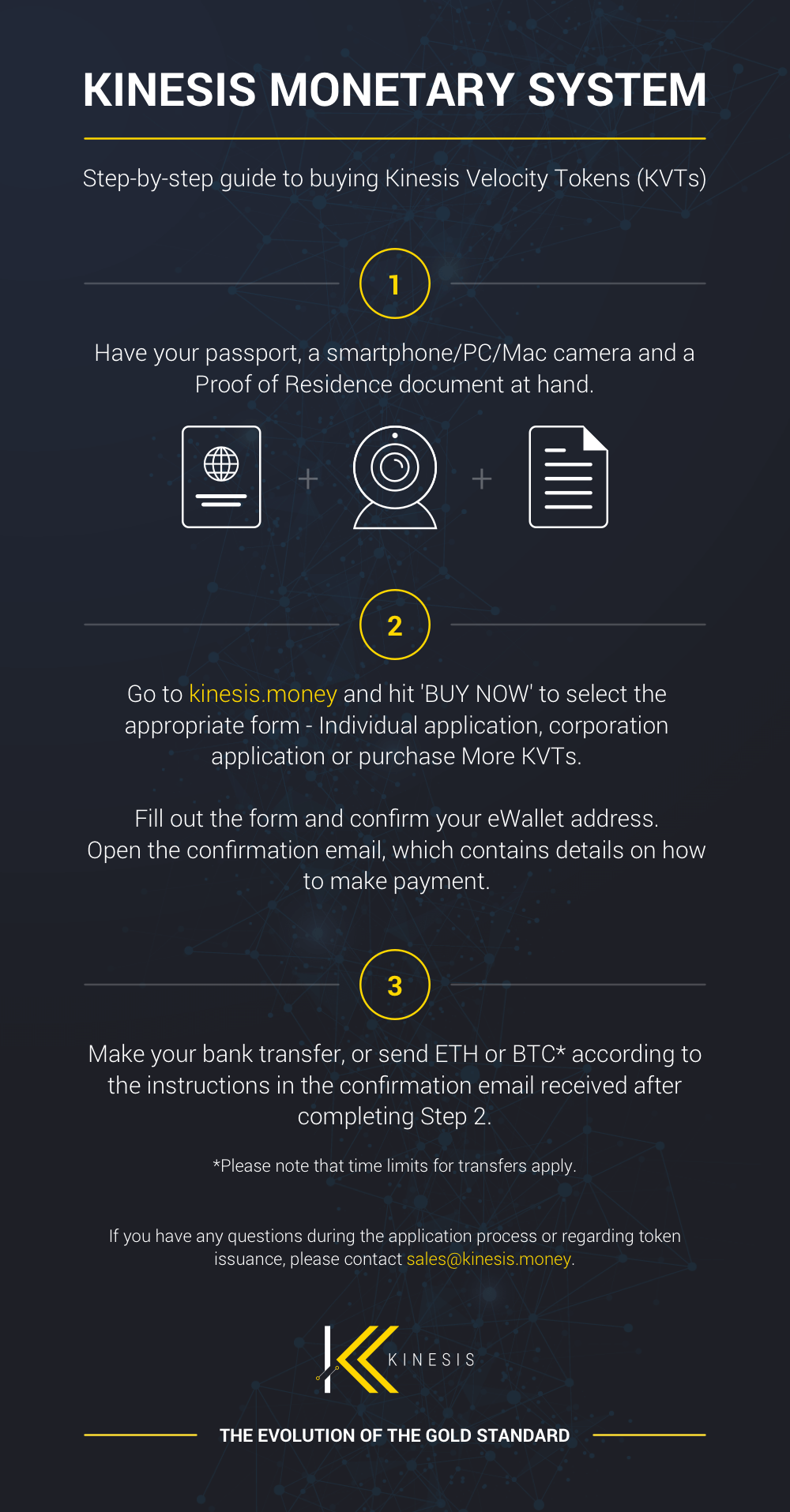

- Kinesis release a new graphic on a step-by-step guide to buying KVTs

Pre-Sale & Public Sale

Sunday the 9th of September marked the day that Kinesis Monetary Systems closed their Pre-sale. Selling over $55million worth of Kinesis Velocity Tokens (KVTs), the company later announced the launch of their public sale the next day.

KVTs are still available to purchase. Suppoters can also keep an eye on their progress and see how many KVTs remain with Kinesis’ new tracker, which can also be found on their homepage. Plus the company now accepts bitcoin as a form of payment.

Kinesis Team Trip to Korea

Last week the team returned from their trip to Korea, where they met with investors and gained great press coverage (Tokenpost, Asia Today and etnews).

Kinesis’ Head of Marketing Jai Bifulco shared insights into the team trip to Korea- saying:

“South Korea is the fourth-largest economy in Asia and has long been in our sights for a number of reasons, the main one being its reputation for taking crypto very seriously. The Government there are investing time and money into making crypto more accessible for everyday people, they’re researching and developing secure blockchain technology and their efforts have already changed the way their population relates to money.”

Some of the main wins that they secured whilst they were away:

- Committed investors who attended a dinner and presentation with Kinesis at PizzaMuzzo, which was hosted by The Collective C

- A video interview with leading Koeran crypto news source Tokenpost (watch the interview here)

- Column inches in etnews, an award-winning finance title (read the article here)

- Asia Today, a leading Korean media brand, gave Kinesis some coverage (read the article here)

- Fruitful meet-ups with powerful contacts via their blockchain consultants, MLG.

Kinesis’ Ryan Case interviewed on ICO Radio

Head of sales and Trading, Ryan Case was interviewed live on air by Barry E James from ICO Radio.

Listen to the Ep. 32 – Reinventing Money: What Happens When the Gold Standard Collides with Crypto & Debit Cards? HERE

Kinesis CEO, Thomas Coughlin interviewed by City AM

Thomas Coughlin, CEO, was interviewed by renowned business newspaper in London, City AM.

City AM shared with its 400,000 weekly readers Kinesis’ use of secure Blockchain tech to re-monetise gold and allow user to go back to the days of using it as an efficient source of everyday currency.

Kinesis release new ‘How to’ Graphic

Check out Kinesis Monetary Systems latest graphic which acts as a guide for those who wish to make purchases.

About Kinesis Money

The vision for Kinesis is to deliver an evolutionary step beyond any monetary system available today. This is achieved by basing the Kinesis currencies 1:1 on allocated physical gold and silver. Use is incentivised by attaching a unique yield system to the Kinesis currencies and distributing back the wealth generated according to proportionate currency holdings and velocity.

Company Updates

Backed By Leading Investment Groups and Family Offices