News and Announcements

St George Mining is on the cusp of another nickel-copper sulphide discovery

- Published October 28, 2020 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

Highlights include

- St George Mining has already discovered four nickel-copper sulphide deposits at its flagship Mt Alexander Project in Western Australia

- Another discovery beckons with drilling underway to test new, powerful electromagnetic (EM) conductors recently identified in an unexplored area of the Project

- The electrical signature of the new conductors is consistent with a massive sulphide source

- All other EM conductors with similar characteristics at the Project have been confirmed by drilling to be massive sulphides with high grades of nickel, copper, cobalt and platinum group metals

- St George Mining is poised for a re-rating as drilling continues to increase its resource inventory against the backdrop of a rising nickel price charged by the gathering pace of the electric vehicle and clean energy revolution

Growth-focused Western Australian nickel company St George Mining Limited (ASX: SGQ) has announced exciting exploration results at its flagship Mt Alexander Project, located in the north-eastern Goldfields. A copy of the Company’s ASX Release dated 21 October 2020 can be viewed by clicking here.

The downhole EM survey of drill hole MAD184 has identified two powerful EM conductors with 49,000 and 16,200 Siemens conductance respectively.

The electrical signature of the new conductors is consistent with a massive sulphide source and indicates strong potential for the discovery of a significant mineral deposit that is likely to include high grades of nickel, copper, cobalt and platinum group metals.

MAD184 intersected a 23.2 metres thick mafic-ultramafic rock unit, an encouraging result as these types of intrusive rocks are known to host massive sulphide deposits in other parts of the Mt Alexander Project.

The drill hole also intersected 5 metres of disseminated and blebby nickel-copper sulphides from 462.7 metres downhole. These disseminated and blebby sulphides can represent the halo around proximal massive sulphide mineralisation and support the potential for the presence of higher-grade mineralisation nearby.

Drilling of the new conductors is underway with the target depth expected to be reached within 7 to 10 days.

St George Mining has already made four high-grade discoveries at the Mt Alexander Project. The new EM targets being drilled are located in an area never explored and success here would significantly increase the footprint of mineralisation at the Project.

Photo: Drill core from hole MAD152, the discovery hole at the Radar Prospect, showing massive sulpide mineralisation which typically contains high-grades of nickel, copper, cobalt and PGEs – all critical metals for electric vehicle and clean energy storage solutions.

John Prineas, St George Mining’s Executive Chairman, said:

“The recent downhole EM surveys have delivered a breakthrough moment with two new exceptional conductors identified from MAD184 that are both interpreted to represent massive nickel-copper sulphides.

“The potential discovery of massive sulphides at these new conductors could be our most important discovery to date as it would confirm the continuity of the high-grade mineralisation at depth and upgrade the western extension of the Cathedrals Belt – which covers the 2.5km long West End Prospect that straddles the major Ida Fault – as a fertile and highly prospective area for further mineralisation.

“With a 100% success rate in testing these kinds of conductors, we are confident that our next significant discovery of massive nickel-copper sulphides is imminent.”

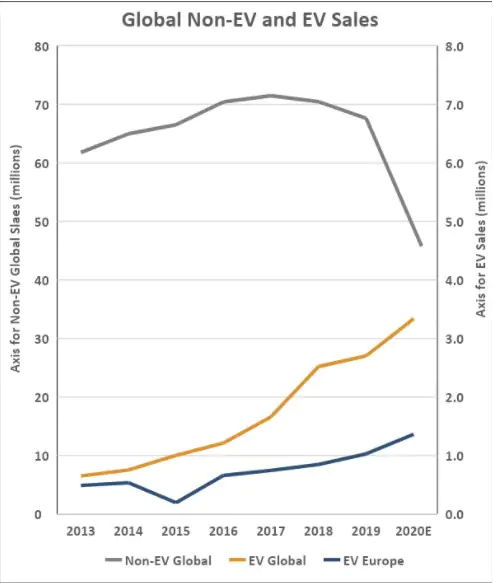

The exploration success at St George Mining comes at a time when the auto industry’s transition to electrification is gaining momentum and impacting significantly on demand for battery grade nickel, which comprises up to 80% of the cathode in electric vehicle batteries.

At the Tesla Battery Day on 22 September 2020, Elon Musk urged mining companies to dig up more nickel and said:

“In order to scale, we really need to make sure that we’re not constrained by total nickel availability. I actually spoke with the CEOs of the biggest mining companies in the world and said, please make more nickel, it’s very important”.

The market price for high-grade nickel is rising and the major players are already scrambling to secure long-term supply. BHP has recently bought the largest undeveloped nickel deposit in Australia, Honeymoon Well, for an undisclosed amount.

In an open offer to mining companies, Elon Musk further started at the 2020 Battery Day:

“Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

St George Mining’s high-grade nickel is sure to find a ready buyer at a handsome price.

With drilling for more nickel deposits underway, there is excellent potential for St George Mining to create more value for its shareholders through new discoveries. It is a very good time to invest in St George Mining.

About St George Mining Limited (ASX: SGQ)

The electric vehicle (EV) and energy storage revolution is advancing rapidly and will create unprecedented demand for key battery metals including nickel, which is the largest component in lithium-ion batteries – the critical power source for leading EV manufacturers like Tesla.

St George has made Australia’s latest nickel sulphide discovery at its flagship Mt Alexander Project in Western Australia. These shallow, high-grade deposits are located in an established mining region, ensuring a clear pathway to commercialization of the discoveries.

Drilling programmes continue to grow the resource inventory at this project, positioning St George to be a big winner as the nickel price rises with a clear upswing in the price cycle underway.

Company Updates

Backed By Leading Investment Groups and Family Offices