News and Announcements

The Warburton Global Fund delivers an annualised return since inception of +32%

- Published June 19, 2018 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

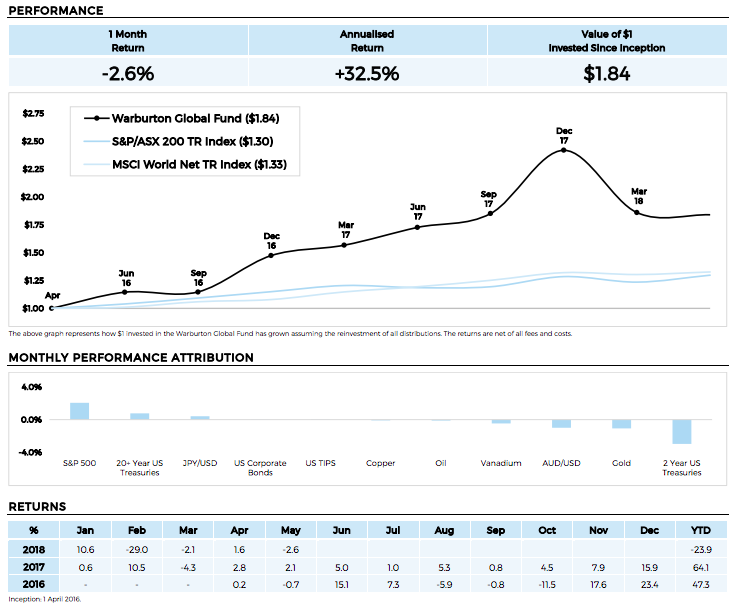

Series 1 units of the Warburton Global Fund returned -2.6% in May 2018. The value of $1 invested since inception is $1.84.

May was a volatile month for the global financial markets. Equity indices were higher in North America but lower in Europe. Most government bond prices increased and the US yield curve continued to flatten, as US Treasury bonds rose in value at both shorter and longer maturities. Commodity price movements varied. Oil and precious metal prices fell, while industrial metal prices were choppy. Both the AUD and JPY strengthened versus the USD.

The Warburton Global Fund generated a soft month of performance. Our profit and loss per instrument was essentially the opposite of last month. We made profits on equities, 20+ year US Treasuries and the JPY, but lost money shorting 2-year US Treasuries. An announcement by OPEC late in the month drained the profits from our oil position.

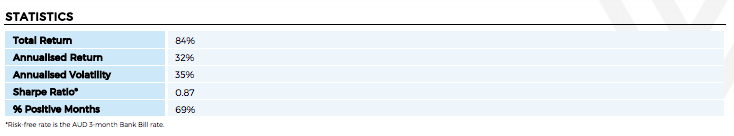

The fund has returned -3% over the last three months, +12% over the last twelve months and +36% per annum over the last two years. With our high-return high-volatility strategy, we do not expect returns to come in a straight line. The trade-off being that by bearing higher short-term volatility, you will achieve higher long-term returns. As such, the performance of the fund to date is exactly in line with our stated objectives. Further, as the fund targets a constant volatility ratio across the whole portfolio, it is specifically designed to take less market exposure in volatile markets and therefore logically have smaller returns during these periods. These risk management protocols are in place to preserve capital during choppy and volatile markets as experienced over the last 3- months. We therefore are satisfied that the quantitative model has performed as expected over this period.

View Warburton Investment Management’s Updated Investor Presentation HERE

About Warburton Global Fund

Warburton Investment Management manages client capital via the Warburton Global Fund, a global macro hedge fund that deals in international investments. The fund invests in public equity, fixed income, currency and commodity markets worldwide.

Company Updates

Backed By Leading Investment Groups and Family Offices