News and Announcements

The Warburton Global Fund delivers an annualised return since inception of +36%

- Published April 26, 2018 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

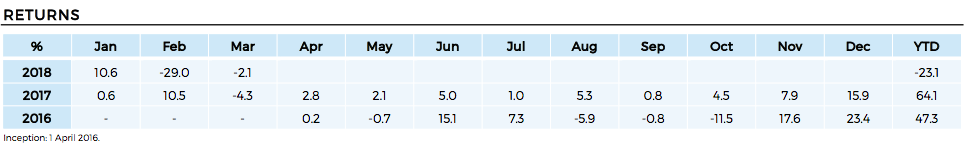

Series 1 units of the Warburton Global Fund returned -2.1% in March 2018. The value of $1 invested since inception is $1.86.

March was a mixed month for the global financial markets. Equity indexes registered losses around the world while government bonds appreciated in price. The US yield curve flattened significantly, as US Treasury bonds gained in value at both shorter and longer maturities. Commodity price movements were mixed. Oil prices rose strongly, precious metal prices were up slightly and industrial metal prices were down. The “battery” metal prices were a mixed bag, with cobalt up 15%, vanadium up 2% and nickel down 4%. Both the AUD and JPY fell versus the USD.

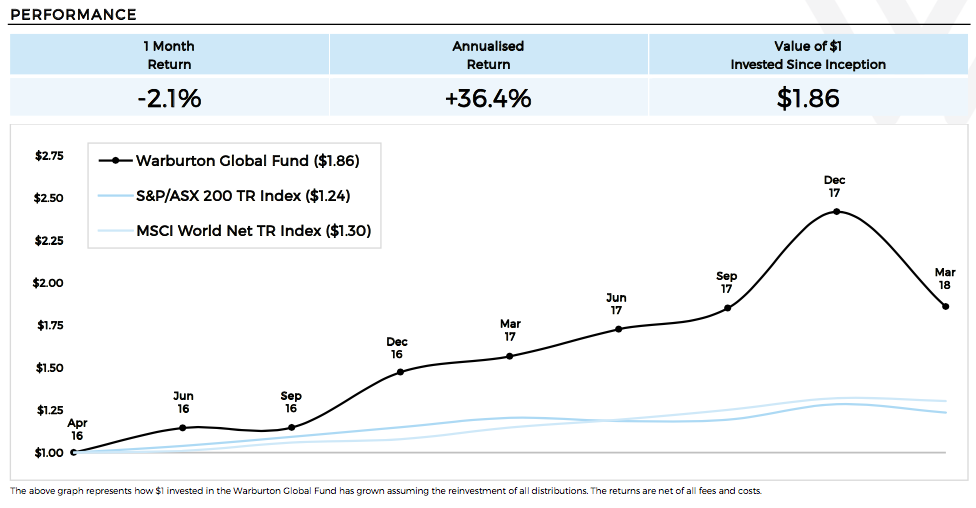

The Warburton Global Fund generated a small loss for the month. The quantitative portfolio was down as it transitioned to the new market regime, while the discretionary portfolio was up, with the entirety of the gains attributable the vanadium positions we accumulated in February.

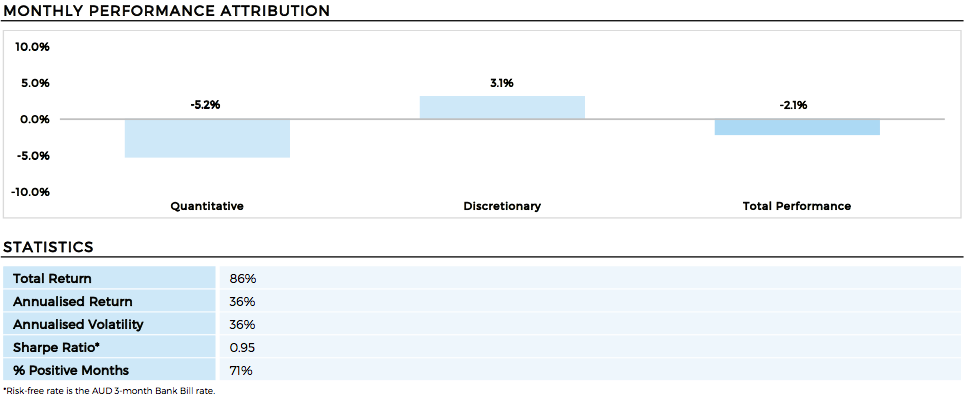

The fund has now been running for two years, over which period it has delivered an annualised return of 36.4%. The performance has exceeded our targeted annualised return of 30% and has placed us as the best performing fund in Australia and the second best performing fund in Asia according to Bloomberg. We remind new and prospective clients that we are a fund for long-term investors and to achieve such high annualised returns one must be willing to tolerate high variability in monthly returns. As our investment strategy specifically targets high annualised volatility, our recommended investment timeframe is at least three years.

The conviction we have in our high return approach is founded in our quantitative investment process, where investment decisions are derived from our quantitative model, which uses over 46 years of global economic data across four asset classes. Since mid-February we have conducted both an investment and operational review. One of the outcomes of the review is that we have decided to increase the fund’s allocation to the quantitative portfolio from 80% to 100% of the fund. By removing the 20% allocation we had to discretionary trading, we eliminate the risk of human error (which was responsible for the fund’s February losses). We have also made a number of enhancements to the quantitative model over the review period, which we expect will improve the amount of return generated per unit of risk. All changes were implemented into the fund on the 1st of April.

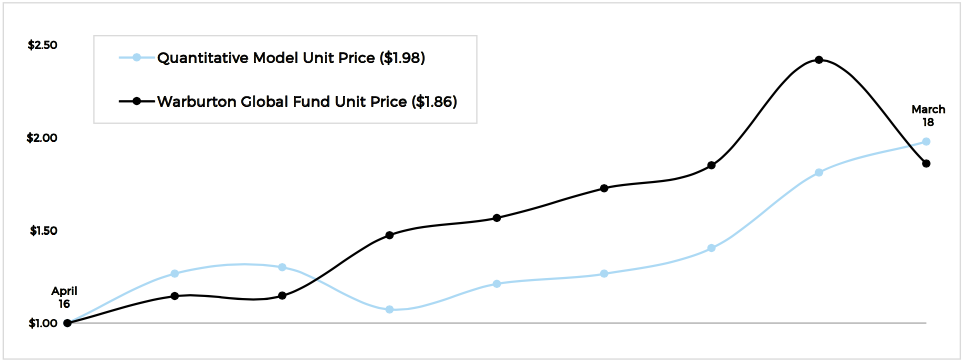

The chart below plots the back-tested returns of a 100% allocation to the quantitative investment strategy, versus the actual returns of the fund over the last two years.

To all our investors, thank you for your continued support during this recent choppy transitioning period in the markets. The quantitative portfolio has dynamically adjusted to become more inflation focussed and we believe this bodes well for near-term returns, We do not however have all our eggs in one basket and the fund has other complementary positions to profit should a number of other scenarios play out. We continue to target high returns and we have high conviction that our quantitative investment strategy will to continue deliver on expectations.

About Warburton Global Fund

Warburton Investment Management manages client capital via the Warburton Global Fund, a global macro hedge fund that deals in international investments. The fund invests in public equity, fixed income, currency and commodity markets worldwide.

Company Updates

Backed By Leading Investment Groups and Family Offices