News and Announcements

The Warburton Global Fund delivers an annualised return since inception of +40%

- Published March 12, 2018 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

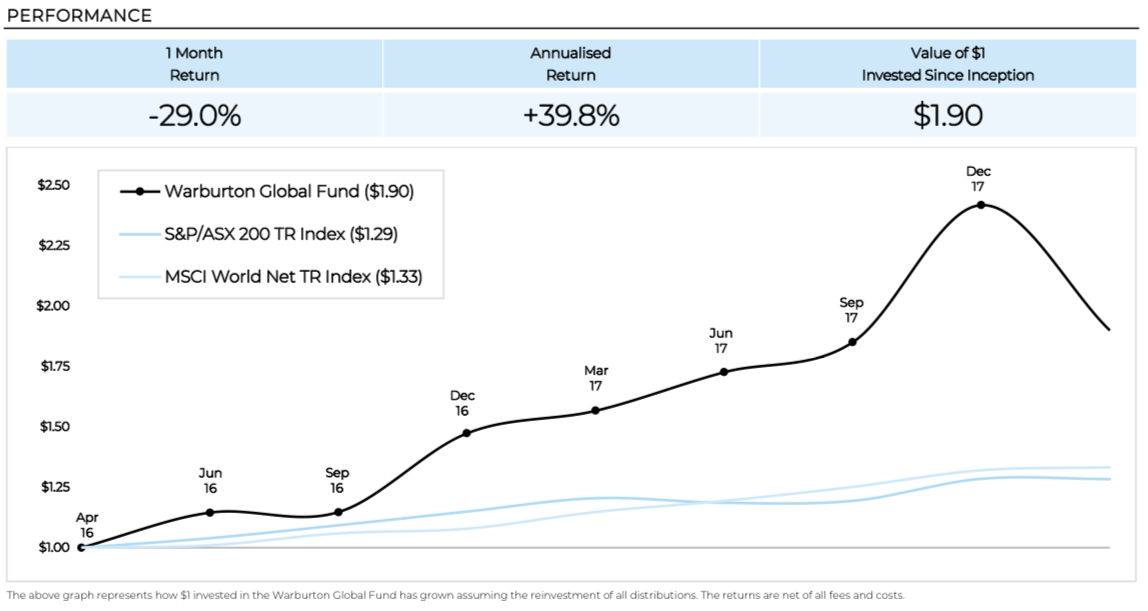

Series 1 units of the Warburton Global Fund returned -29.0% in February 2018. The value of $1 invested since inception is $1.90.

Through some extremely unlucky timing, we lost -24.0% being short bonds, in a month where being short bonds was a profitable trade.

February was a volatile month for the global financial markets. Equity indexes registered large losses around the world. Government bond prices were down noticeably. The US yield curve steepened, as US Treasury bonds lost value at both shorter and longer maturities. Commodity prices generally fell. Precious and industrial metal prices were down solidly. Oil prices plunged. Prices of “battery” metals bucked the trend, with nickel up 1%, cobalt up 1% and vanadium up 2%. The AUD was down sharply versus the USD.

Considering we had anticipated the impending market correction, had put on a hedge to protect the fund and had very little equity market exposure, the Warburton Global Fund registered an unexpected month of performance. February’s return can be broken into the following components:

- The quantitative portfolios:

– High-conviction quantitative -2.2%

– Diversified quantitative: -3.0% - The vanadium holdings: +0.2% 3. The 1st short bond trade: -12.0% 4. The 2nd short bond trade: -12.0%

Below is a step by step walkthrough of each component’s performance.

1. The Quantitative Portfolios

In the prevailing market conditions, our two quantitative portfolios performed far better than expected. We significantly outperformed our competitors who run similar quantitative strategies. Our quantitative portfolios quickly adapted to the worsening environment by reducing overall capital and duration exposure to the market. They minimised initial losses whilst also registering gains towards the end of the month, finishing down only -2.2% for the high- conviction quantitative portfolio and -3.0% for the diversified quantitative portfolio. The comparatively strong performance of our quantitative strategies demonstrates their ability to dynamically navigate all market conditions.

2. The Vanadium Holdings

We added the first stock to our vanadium holdings. The stock finished the month +7% higher than our purchase price and contributed +0.2% to our fund’s overall monthly return. Vanadium prices rose during the month while most other asset class prices fell. Our vanadium holdings provide another source of uncorrelated returns for the fund and we continue to remain positive on the underlying fundamentals that drive vanadium prices.

3. The 1st Short Bond Trade

Short bonds had been a profitable trade for us in January. The FOMC statement on the Wednesday 31st of January was hawkish, as expected, and US bond prices continued to fall, creating profits for our fund. However, what caught our attention was that since the FOMC statement was released, volatility in the US equity market had started to rise, with the VIX going from 13 on Wednesday to 17 on Friday.

We had written at length in our previous two monthly reports explaining how rising interest rates would reach an “inflection point” and cause a “regime change” that would affect the pricing of all major global asset classes. We believe the FOMC statement on the 31st of January provided the inflection point for the regime change and became the catalyst for the subsequent correction in prices of all major global asset classes.

On Friday the 2nd of February, with the VIX at 17, and well-aware that we were likely to enter a correction, we assessed the potential weak points of our portfolio and also ways that we could generate extra profit. Equity market exposure was our biggest concern, but with the VIX rising, our quantitative portfolios had already reduced our exposure to the equity markets. Additionally, our quantitative portfolios had also lowered our entire capital allocation to the wider asset markets, to a level significantly lower than our average exposure.

The most logical trade to us was to increase the size of our short bond position. We figured that if other asset prices were to fall due to rising interest rates, then the profits from a large short bond position would more than offset any potential losses in our quantitative portfolios.

The construction of the fund’s portfolio for February was therefore quite straightforward. It comprised our usual allocation to our quantitative portfolios, a large short bond position (to hedge the quantitative portfolios should yields rise (i.e. bonds fall)) and an allocation to vanadium, to profit from rising vanadium prices.

To hedge the quantitative portfolios, we had inadvertently created concentration risk in the discretionary portfolio. In hindsight, instead of taking such a large short bond position, we should have taken a smaller position and combined it with a complementary and uncorrelated long VIX futures position. The short bond position would hedge the quantitative portfolio against a longer drawn-out correction, but if assets prices were to correct faster than we anticipated, then the profit from the VIX futures would mitigate any short-term loss. Additionally, should bonds react to a sharp correction by rallying, the long VIX futures position would offset any losses from the short bonds position.

By having two smaller, uncorrelated but complementary positions, rather than one large concentrated position, we would have navigated either a sharp correction (via long VIX) or a longer drawn-out correction (via short bonds) equally as successfully.

Black Monday 2018

Having just increased the size of our short bonds position the previous Friday, on Monday the 5th of February the Dow Jones Index fell over 1000 points in one- day for the first time in history. The VIX spiked 114%, marking the largest one-day spike in volatility since Black Monday in 1987. As investors fled to safe-haven assets, bonds rallied hard. In line with our pre-determined risk protocols, our stop loss of -12% was reached on our short bond position, so we closed the trade and crystalised the loss. Taking into consideration the size of the position and the target volatility of our fund, we had set the stop loss of the position quite wide so as not to get unreasonably stopped-out in the increasingly volatile markets. What we had not factored in was a once in a 30-year volatility event.

After a strong January, the fund was still up for the year at this point. Other uncorrelated positions in the quantitative portfolio had contributed to profits on the day.

Despite being extremely unlucky, with the VIX rallying more than 100%, we were satisfied with the risk management process on the short bond position. When analysing that day’s trading, we made certain not to confuse the bad outcome with what we believed to be a good risk management process. Sometimes you can get lucky using a bad process (i.e. holding and hoping for a recovery), while other times you will be unlucky using a good process (i.e. risk management). Over the long-term however, the probabilities will play out, and good processes will outperform bad processes, and provide better long-term performance outcomes.

4. The 2nd Short Bond Trade

By Wednesday, US bond prices had mean-reverted such that yields were now back to the levels that they were at prior to Monday’s fierce rally in bond prices. The once in 30-year percentage spike in the VIX looked to have played out, and volatility was declining across all asset classes. We therefore decided to place back on the same short bond trade from earlier in the month. Our timing was again unlucky. Had we waited an extra day to place the trade, then the fund would have returned a positive performance for the month. Instead, the next day, Thursday the 8th of February, became the second day in history that the Dow Jones Index fell over 1000 points in one-day. Investors fled to safe-haven assets again and bonds rallied hard. For risk management purposes we covered our short bond position and crystalised another loss of 12%.

We acknowledge that our trade sizing in the bond shorts was too large in the context of the extreme market volatility. This caused us to crystalise unnecessary short-term losses due to our necessity for risk management. Had we ignored all our risk management processes and held the positions from inception until the end of the month, the fund would have returned a profit of +7.0%. Despite the two sharp bond rallies, being short bonds was a profitable trade in February, as US Treasuries bond prices registered negative performance over the month.

Summary

By trying to hedge the entire quantitative portfolio with only one large trade (i.e. short bonds), we had inadvertently put the fund in a position where one trade had the ability to have an outsized effect on the return and risk of the fund. We want to emphasise that this position was undertaken purely as a hedge. While we called the direction of the market correctly, our error was in not creating the appropriate hedging balance. The success of our fund over the last two years has been driven by investing across a widely diversified spectrum of uncorrelated return streams such that no one position had the ability to have a disproportionate impact on the fund’s returns. The inadvertent error we made was having a concentrated hedging position in our discretionary portfolio. Our discretionary investment process has been updated accordingly so that we prevent any such scenario from happening again in the future.

Prior to this month, the fund had generated 10 consecutive positive months of performance in a variety of market conditions. February was an exceptionally unlucky month for the fund and we are still targeting an annual return of over 30% for the year. As such, with the fund down -25.1% as of the end of February, our portfolio manager has used this opportunity to add to his investment in the fund. We believe that the current drawdown provides an excellent entry point for both new and existing investors to invest in the fund.

About Warburton Global Fund

Warburton Investment Management manages client capital via the Warburton Global Fund, a global macro hedge fund that deals in international investments. The fund invests in public equity, fixed income, currency and commodity markets worldwide.

Company Updates

Backed By Leading Investment Groups and Family Offices