News and Announcements

WealthLander Diversified Alternative Fund reports another positive-return month, which takes it to 20.7% return since inception

- Published January 19, 2022 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

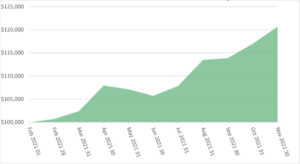

November delivered another positive return of 3.2%. Performance is 20.7% since inception on 1 February 2021 (assumes distribution reinvestment). Returns are net of all fees and costs. An investment in the Fund of $100,000 since inception, from February 1 2021, is valued at approximately $120,658 as at 30 November 2021.

This month delivered another positive result despite broader markets being weak again. The fund’s underlying themes and strategies had mostly positive returns for the month given how they were positioned. The team also made money from successful use of their market hedges in SPY puts and VIX calls, as well as from Tesla puts providing them protection (considering that Tesla stock had become too exuberant given the circumstances.). Their currency position and diversification in USD also added some value. They had mixed performances in precious metals; they made some money timing a position in a gold ETF but lost more from gold equities as precious metals had another weak month. The fund also lost from our Uranium position.

Markets are becoming more tenuous and the fund’s risk radar is raised as the team looks to enter 2022. They believe in being in equity markets selectively and only when expecting material outperformance from active management, and safer than simply speculating on the broader market continuing to rise ad infinitum. Investors might care to consider whether this approach would also work best for them and be better aligned to their own goals.

Investors looking for diversification and a focus on better risk adjusted returns, and those worried about equity and bond market losses or low returns may be able to put money to work effectively and/or substitute or add to their existing investments by considering an investment in the fund (obviously we don’t give personal advice and investors should consider their own objectives and preferences). Switching from equities to alternative strategies may be of interest to some people right now and could prove long term fortuitous, as large equity gains may be permanently captured through selling.

Company Updates

Backed By Leading Investment Groups and Family Offices