News and Announcements

Wildfire Energy Awarded a $1M Grant to Convert Farm Crop Residues to Green Hydrogen

- Published October 28, 2021 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

Wildfire Energy is pleased to announce it has been awarded a $1 million grant from the Australian Government Department of Industry, Science, Energy and Resources to convert farm crop residues into green hydrogen using its MIHG technology. The grant is awarded as part of the Business Research and Innovation Initiative (BRII) Proof of Concept stage and follows the successful completion of the Feasibility Study stage earlier this year.

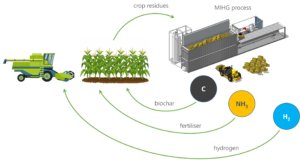

Wildfire will continue to work with the Grains Research Development Corporation (GRDC) and CSIRO to demonstrate the conversion of farm crop residues, such as wheat straw, into green hydrogen which is suitable for ammonia synthesis and for use in fuel cell vehicles. The project will progress the concept of using our MIHG technology to realise a circular economy on the farm.

The grant funds will contribute to the installation of new equipment at Wildfire’s existing pilot plant to produce green hydrogen from farm crop residues and will also be used to identify potential customers and undertake commercialisation activities so that a modular solution is ready for widescale deployment by the end of the project in Q1 2023.

“Wildfire is excited to have been awarded this funding and looks forward to building on our great working relationships with the BRII, GRDC and CSIRO teams. This grant funding is further recognition of the potential of our MIHG technology to help with decarbonising the agricultural sector.”, said Greg Perkins, Co-founder and CEO of Wildfire Energy.

The infographics below shows how Wildfire’s MIHG technology can be used to produce green hydrogen from farm crop residues in a sustainable manner using circular economy principles.

Company Updates

Backed By Leading Investment Groups and Family Offices